Alviere, an embedded finance startup that aims to help any brand deliver financial products and services to its customers and employees, announced today it has closed $70 million of new funding.

In April, New York-based Alviere closed a $20 million Series A led by Viola Ventures and Viola Fintech, with the participation of CommerzVentures, Mitsubishi Capital Corporation, Wix.com Capital, Draper Triangle Ventures, Cross River Bank Capital, CERCA Partners and others.

Now, just six months later, the startup is announcing an additional $50 million in Series B investment. Unnamed institutional fintech investors led the latest financing, which included participation from existing backers Viola Ventures, Viola Fintech and CommerzVentures, as well as Cleveland-based North Coast Ventures. Opera Tech Ventures, the VC arm of BNP Paribas, also put money in the round. Alviere has now raised a total of $90 million since its 2017 inception.

Embedded finance is a hot topic these days and it feels like we’re seeing a growing number of rounds in the space. Just last week, TechCrunch reported that Productfy, a banking-as-a-service (BaaS) company that aims to build “DeFi for traditional finance,” raised $16 million in a Series A round of funding led by CM Ventures.

Yuval Brisker, CEO and co-founder of Alviere, started the company with Pedro Silva a few years after having sold his previous company, TOA Technologies, to Oracle in a deal rumored to have valued it at over $500 million. (TOA was a Cleveland, Ohio, cloud-based enterprise software company.)

He is loathe, though, to slap the BaaS label on his newest startup.

“We’re doing embedded finance, which is as big or bigger than BaaS,” Brisker told TechCrunch.

Whatever you want to call it, the market for embedded finance is massive and expected to grow worldwide to become a $7.2 trillion market by 2030, according to a forecast from Simon Torrance. Last year, the banking-as-a-service market alone was valued at $356 billion, according to Verified Market Research.

The foundations of Alviere were born out of an attempt to build a payment app to exchange money without exchanging personal information.

“We quickly learned that was not an easy undertaking,” he recalls. “But what we built for ourselves, we realized we could white label and sell to others.”

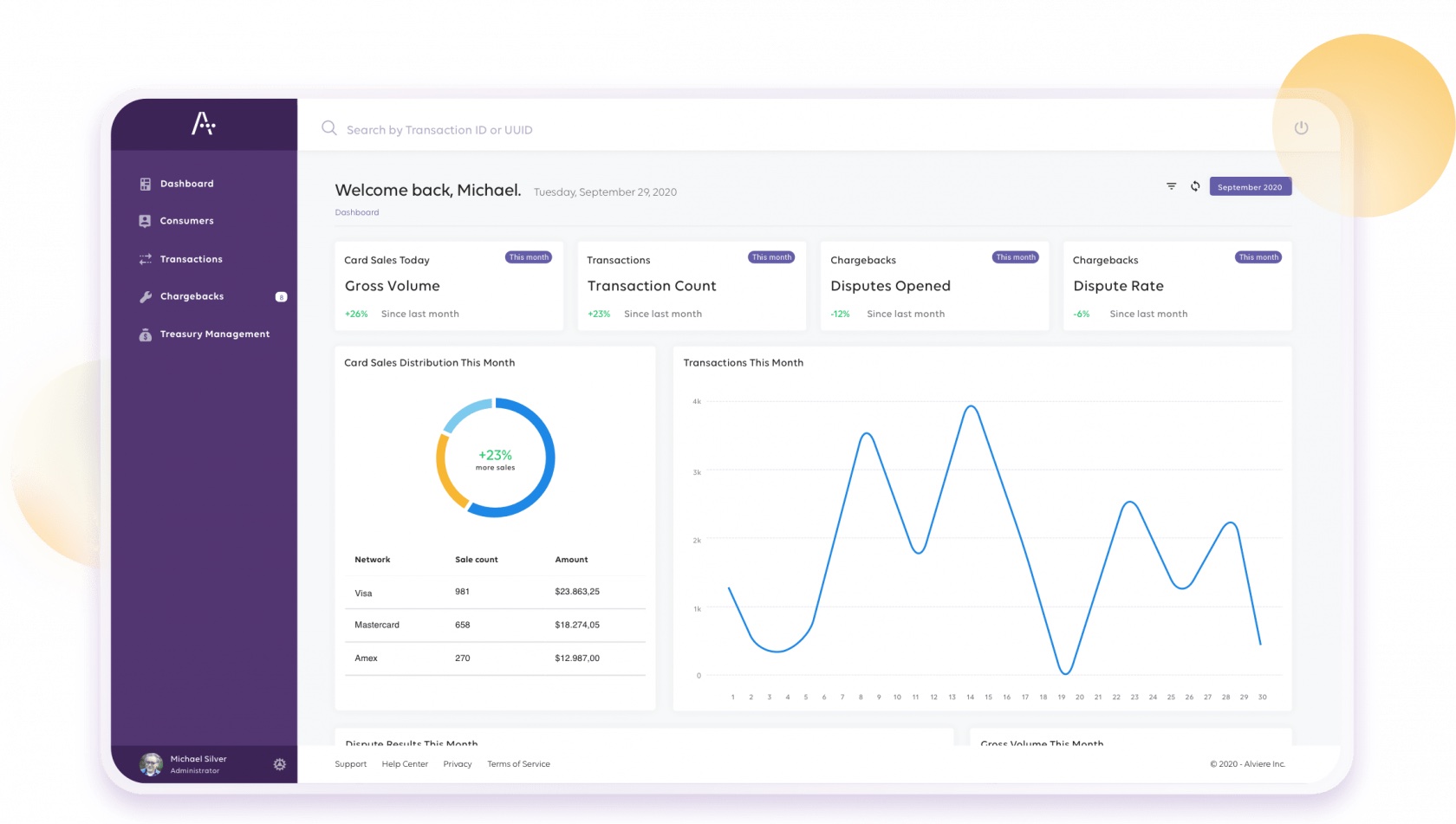

But instead of building a consumer app, the team decided to package the solution — dubbed The HIVE — to businesses or brands to be able to launch any financial service on their own.

So, how is this different from BaaS?

“When I look at BaaS offerings, it is usually selling technology to tech mavens who can use it to actually either accelerate the ability to build financial products or embed those products in their software or technology,” Brisker said. “That’s not what we’re doing.”

Instead, he added, Alviere is going more mainstream and after brands that don’t currently offer any financial technology and don’t know how to do it but might have an existing loyal customer base. By using Alviere, those customers would be able to go to customers, he said, and say, “Hey, we now offer a bank account.” And rather than a partnering bank owning the customers, the actual brand would own the customers.

Brisker doesn’t see Alviere’s offering as a threat to banks. His argument is that by removing the “pain” of having to deal with customers, banks can actually improve profitability.

“When you take away a lot of the customer service components you’re going to have a much more efficient operation, and they’ll still be able to have the deposits and the lender loans,” he told TechCrunch.

Alviere plans to use its new capital in part to expand beyond North America (it is licensed in “almost” all 50 U.S. states) to Europe and Latin America. The goal is to provide financial services to a new cohort of users.

Fortune 500 companies are Alviere’s target, and so far, it has closed deals with two unnamed brands that each have more than 10 million household subscribers or customers. The startup’s business model relies on its customers’ success, according to Brisker. Basically, it shares the revenue it makes with its customers, which will make money each time on interchange fees each time a branded credit card is swiped.

“We’re deeply embedded in their business on multiple levels,” Brisker said. “Embedded finance technology is taking the decentralization of financial services to the next level. Now any brand with an existing customer base — be it a telco, a retailer, a shoe company, an automobile company, a marketplace — will be able to deliver financial products and services to its customers.”

The company claims that by using its software, brands can start lucrative lines of businesses that can allow them to deliver “everything personal finance” to their customers.

Image Credits: Alviere

Financial services that Alviere’s HIVE enables brands to embed in their business include direct deposit FDIC Insured checking and savings accounts; credit, debit, prepaid and gift cards; payment services; domestic and international money transfers; loyalty programs and cash pick up and deposits.

Omry Ben David, general partner at Viola Ventures, said his firm had been proactively looking to make a play in the embedded finance space for “quite some time.”

“As legacy fintech investors for the past 20 years, we believe consumer financial services are undergoing a tectonic shift and that the next consumer banking revolution will be for established brands to offer bespoke, well-crafted financial services to their existing, and new, loyal audiences,” he wrote via e-mail. “Be it a checking/savings account, branded credit card, loyalty or gift cards, BNPL loans, digital payments services, remittance, etc. – all ‘programmed’ and inter-connected to suit a specific consumer segment, geography and/or need. No more ‘one size fits all.’ ”

"help" - Google News

October 12, 2021 at 08:01PM

https://ift.tt/2YQ5wh3

Alviere lands $70M in funding to help brands offer bespoke financial products and services - TechCrunch

"help" - Google News

https://ift.tt/2SmRddm

Bagikan Berita Ini

0 Response to "Alviere lands $70M in funding to help brands offer bespoke financial products and services - TechCrunch"

Post a Comment