The Affordable Care Act (ACA) created new health coverage options and financial assistance to expand coverage and help people remain insured even when life changes, such as job loss, might otherwise disrupt coverage. The ACA also established in-person consumer assistance programs to help people identify coverage options and enroll. A variety of professionals provide consumer assistance, including Navigator programs that are funded through state and federal marketplaces, brokers who receive commissions from insurers when they enroll consumers in private health plans, local non-profit organizations, and health care providers. Recent funding cuts have reduced the availability of Navigator programs.

In the spring of 2020, KFF surveyed consumers most likely to use or benefit from consumer assistance—nonelderly adults covered by marketplace health plans (also called qualified health plans, or QHPs) or Medicaid, and people who were uninsured—to learn who uses consumer assistance, why they seek help, and what difference it makes as well as who does not get help and why. The survey also explored differences in help provided by marketplace assister programs and brokers. Key findings include:

- Nearly one in five (18%) consumers who looked for coverage or actively renewed their coverage, or about seven million people, received consumer assistance in the past year. Most who enrolled in coverage with help said assistance made a difference; 40% think it is unlikely they would have found coverage without help.

- Another 12% of target consumers—nearly five million people—tried to find help but did not get it, suggesting there is a shortage of consumer assistance. Among target consumers who were not helped in the past year, two-thirds said they would likely seek consumer assistance if it were available.

- Roughly one in four marketplace enrollees who were helped by a broker or commercial health plan representative said they were offered a non-ACA compliant policy as an alternative or supplement to a marketplace policy. Brokers and commercial health plan representatives rarely help with Medicaid enrollment.

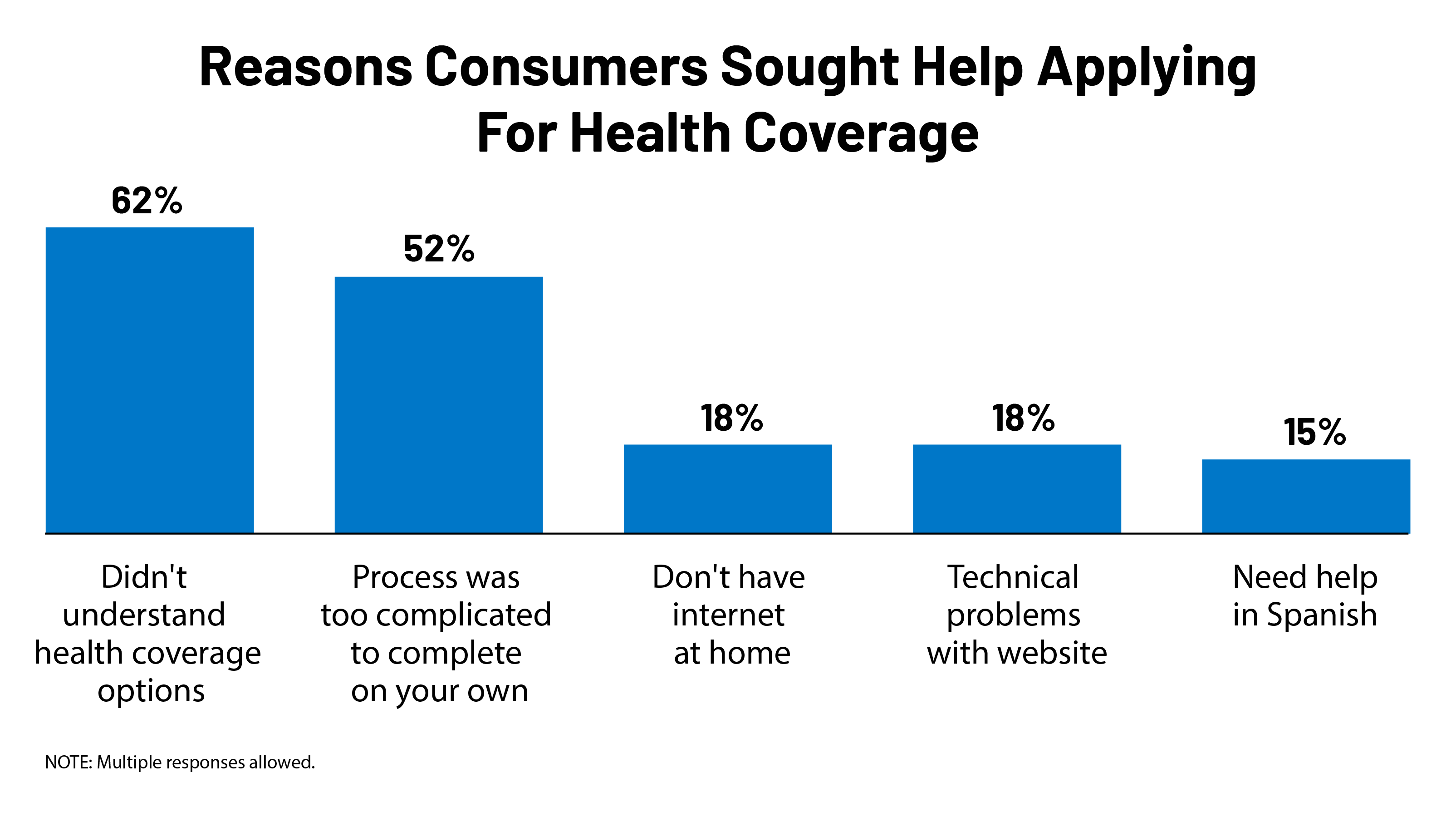

- The COVID-19 pandemic could disrupt health coverage for potentially millions of people, but the findings suggest that public understanding of available coverage options and how to apply is limited. Most people who are uninsured or have marketplace of Medicaid coverage do not know or are unsure if the ACA has been overturned, if their state has expanded Medicaid eligibility, or time frames when they can apply. Consumer assistance could help people identify and navigate replacement coverage options.

- Consumer satisfaction with marketplace plan coverage is generally high; satisfaction with Medicaid is even higher. Three-fourths of marketplace enrollees said, overall, they were very or somewhat satisfied with their plan coverage; among Medicaid enrollees, it was 93%. Medicaid enrollees were also significantly more satisfied with the level of cost sharing and with their choice of doctors and hospitals compared to marketplace enrollees.

"assistance" - Google News

August 07, 2020 at 07:41PM

https://ift.tt/2DnKpZ0

Consumer Assistance in Health Insurance: Evidence of Impact and Unmet Need - Kaiser Family Foundation

"assistance" - Google News

https://ift.tt/2Ne4zX9

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Consumer Assistance in Health Insurance: Evidence of Impact and Unmet Need - Kaiser Family Foundation"

Post a Comment