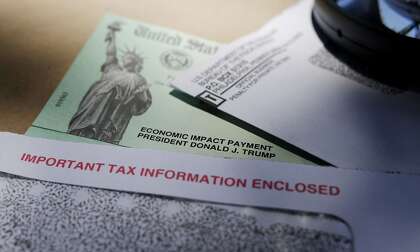

Today I have answers to readers’ questions on unemployment, stimulus checks and who’s helping the homeless get their economic impact payment.

Q: Do I need to report the $1,200 federal stimulus check on my unemployment certification form, and will it affect the unemployment amount?

A: No and no. “The stimulus money does not need to be reported to the EDD and is not deductible from (unemployment) benefits because it is not payment for services performed,” Loree Levy, a spokeswoman for the Employment Development Department, said in an email.

Q: The print shop my wife and I own has been closed since March 17 under the shutdown order. Our two employees filed for unemployment while we waited for a Paycheck Protection Program loan. We got our loan on May 7 and started paying our employees what they’re getting on unemployment, which is more than their salaries. We’re paying ourselves the same salary as before. How should we handle the certification process on the EDD’s website for these eight weeks we’re getting paid through PPP and how will it affect things if we need to go back on unemployment after the PPP coverage period ends July 7. Should we just not certify anything or should we fill out each week’s form showing we are getting our usual wages from our current employer?

A: “If the employer is paying themselves a full salary as if they are fully employed and they are receiving pandemic unemployment assistance, they should either report their wages on their continued certifications for each week they pay themselves from the PPP loan or stop certifying for benefits because they will be considered fully employed,” Levy said in an email.

“If they have to close their business or reduce their business hours following the weeks of paying themselves from the PPP loan, and they are unemployed due to one of the COVID-19 reasons, at that time they can re-apply to reopen their PUA claim,” she continued.

“The same would apply to their employees. If they are being paid wages under the PPP program, they can either report the gross wages on their continued claim form for each week of benefits claimed, or discontinue their UI benefits by not certifying. A claim is good for one year and if the PPP wages end or some other impact occurs on their employment, they can reopen their claim at that time.”

They can reopen a claim through UI Online, which is “fast and convenient,” she added. “So it really is up to the claimant as to how they want to deal with their income and probably depends too on how long they may anticipate getting wages through the PPP program.”

Q: Did the homeless in Oakland and San Francisco get help applying for stimulus checks? I noticed how stressed the homeless in my neighborhood seem so I’m wondering what help is available.

A: Many people who are eligible for economic impact payments are receiving them automatically. This includes people who filed a 2018 or 2019 tax return and had a refund directly deposited into a bank account.

It also includes people who did not have enough income to file a tax return and didn’t file a return (perhaps to get refundable tax credits), but do receive Social Security retirement, survivors or disability benefits; Supplemental Security Income; railroad retirement or certain veterans benefits. They are getting their stimulus payment the same way they get those benefits, without having to apply.

Unfortunately, many homeless people don’t file a return or get any of those benefits and for them, applying for, getting and using the payment can be a real challenge, especially because so many places where they might get help are closed. “The people who need it most immediately need to jump through 18 hoops to get it,” said Jenna Statfeld Harris, an attorney with Bay Area Legal Aid.

The only way they can get the payment is to apply on the IRS website for non-filers. That requires a computer, internet access and an email address. When libraries, nonprofit agencies and free tax-preparation sites sponsored by the IRS and the AARP Foundation reopen, they could get help there.

In the meantime, nonprofits are doing what they can to help out.

“If someone comes to our case management tent, and says I don’t have Social Security or SSI, we help them sign up on the website to get that sent,” said Brittany Hodge, director of programs with St. Anthony’s Foundation in San Francisco.

“If they have a photo ID, they can have their check sent to St. Anthony’s. If they don’t have a photo ID or any ID, we can’t accept the check here,” she said. They could have the check sent to someone they know, “or another service provider they are more closely associated with,” Hodge said. But they will need a photo ID to cash the check. Getting a photo ID from the Department of Motor Vehicles has been problematic during the pandemic although 70 offices are now open.

“I’ve heard some social service agencies are holding checks for people,” but they may be closed for now, said Steven Weiss, regional managing attorney with Bay Area Legal Aid.

Legal Aid is helping its clients apply and “getting referrals from community groups if they hit a roadblock,” Weiss said. Once they get a check, they need somewhere to cash it and keep the money, which is a problem if they don’t have a bank account.

If they are receiving benefits such as CalFresh or general assistance on an Electronic Benefit Transfer card, when they register on the IRS website they may be able to get their stimulus money loaded onto the card, but they need to call a number to get the account and routing number (it may be different than the card number) and make sure it’s refillable, Statfeld Harris said.

If they don’t have a debit card or bank, they could go to joinbankon.org and find a list of banks and credit unions offering “affordable” checking accounts, she added.

They could also go to a check-cashing outlet and pay a fee. It would be easier if they could get their payment on one of those MetaBank debit cards the IRS has begun sending out, but people can’t ask to have their stimulus payments that way.

One problem they have run into: People who do apply find that they are ineligible for the payment because someone else claimed them as a dependent in 2018 or 2019, or the payment was sent to a current or former spouse they don’t live with based on a joint tax return.

Weiss added that the stimulus money should not cause anyone to lose benefits such as Medi-Cal, CalWORKs and CalFresh, which receive federal dollars, and it won’t affect any need-based program in the Bay Area.

The good news is, “there’s no imminent deadline,” Weiss said. If they complete the IRS non-filer application by Oct. 15, they will get a payment this year. It’s unclear whether the website will operate after Oct. 15, but if it doesn’t, people can claim the payment when they file a 2020 tax return.

Weiss said some people who need help may want to wait until libraries, social services and free-tax preparation sites reopen. To reach Bay Area Legal Aid call 800-551-5554.

Kathleen Pender is a San Francisco Chronicle columnist. Email: kpender@sfchronicle.com Twitter: @kathpender

"help" - Google News

June 06, 2020 at 10:05PM

https://ift.tt/37488Yw

Answering questions on stimulus payments, unemployment and help for the homeless - San Francisco Chronicle

"help" - Google News

https://ift.tt/2SmRddm

Bagikan Berita Ini

0 Response to "Answering questions on stimulus payments, unemployment and help for the homeless - San Francisco Chronicle"

Post a Comment